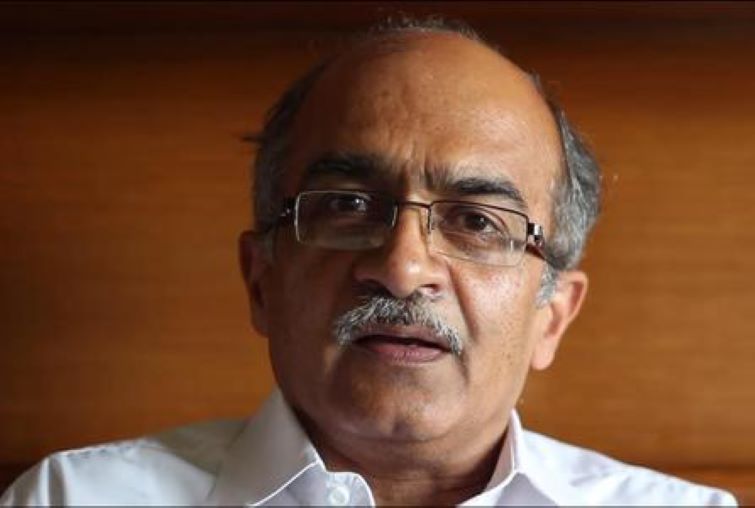

Prashant Bhushan files contempt petition against SBI on electoral bond issue

New Delhi/IBNS/UNI: Senior Advocate Prashant Bhushan on Thursday mentioned a contempt petition in the Supreme Court against the State Bank of India for not complying with its direction to disclose details of electoral bonds to the Election Commission of India (ECI) by March 6.

Senior Advocate Prashant Bhushan appearing on behalf of two NGOs, Association for Democratic Reforms (ADR) and Common Cause sought an urgent hearing for the contempt petition filed against the State Bank of India (SBI) for alleged non-compliance with the Supreme Court's order to disclose details of electoral bonds by March 6.

Bhushan appeared before Chief Justice D Y Chandrachud insisting that his contempt petition be tagged with SBI’s petition which sought an extension to implement the Supreme Court order till June 30 to furnish details of the electoral bonds.

Bhushan told the CJI that SBI has filed an application for extension which is likely to be listed on Monday.

Association for Democratic Reforms filed a contempt petition asking that its application be also listed along with that.

CJI told Bhushan to send an email request with the details of the application number.

Bhushan in his petition has alleged that the SBI has deliberately not complied with the Supreme Court orders and said that this action attracts contempt proceedings.

ADR and Common Cause contend that SBI, the issuing bank of electoral bonds, has failed to furnish vital information regarding the bonds to the Election Commission of India (ECI) within the stipulated time frame till March 6 set by the apex court.

A constitution bench of the Supreme Court had directed the State Bank of India to submit details of electoral bonds purchased since April 12, 2019, to the Election Commission of India by March 6.

However, days before the deadline, the bank filed an application seeking an extension till June 30, citing the complexity of decoding and compiling data from the sale of these bonds.

ADR, the election watchdog, and Common Cause's contempt petition challenge SBI's extension request.

The NGOs argue that the State Bank of India possesses the necessary infrastructure to swiftly compile and disclose information on electoral bonds. ADR's plea has alleged that the SBI violated the apex court's directions. ADR was the lead petitioner in the electoral bonds case.

SBI's IT system, designed for managing electoral bonds, is already in place and can easily generate reports based on the unique numbers assigned to each bond, the petitioner said.

Bhushan in his petition said that the bank has records of the unique numbers allotted to each electoral bond and the Know Your Customer (KYC) details of purchasers. And also the SBI has a vast network of branches and a well-functioning IT system, making the task of compiling data for approximately 22,217 electoral bonds straightforward.

The petitioner alleged that the SBI’s move to seek extension is 'mala fide' and an attempt to thwart transparency efforts before the upcoming Lok Sabha elections.

Bhushan further contended that voters have a fundamental right to know about the substantial sums of money contributed to political parties through electoral bonds.

The lack of transparency goes against the essence of participatory democracy enshrined in Article 19(1)(a) of the Constitution, the petitioner said.

The Supreme Court scrapped the electoral bonds scheme on Feb 15. A five-judge bench comprising Chief Justice of India, DY Chandrachud, Justices Sanjiv Khanna, BR Gavai, JB Pardiwala, and Manoj Misra delivered a unanimous verdict.

The top court had declared the issuance of electoral bonds as unlawful and directed the SBI to stop the issuance of the Electoral bonds forthwith. It had directed the SBI to disclose details of the political parties that received contributions through electoral bonds.

These details were to be published by the Election Commission on its website by March 13, 2024, The SBI, however, could not furnish the details within the stipulated time and asked for an extension of time to furnish the said details.

The case will come up for hearing on March 11 when the bank's plea for an extension will also be heard by the top court.